A Berkshire foodbank said it was "worried" about getting enough donations in January. Annette Medhurst, manager at Wokingham Foodbank, said she hoped the donations during the Christmas period would help the decrease in donations in January during the "quieter period". According to the foodbank there has been an increase of more than 90% in referrals since 2019. Ms Medhurst added: "Donations will definitely drop, we hope that the things we have got in during the run-up to Christmas will help see us through." Ms Medhurst said that more people get referred to the foodbank in the New Year. She said: "We get a lot of donations during harvest festival and in the run-up to Christmas, those donations really help see us through the quieter times. "This time of year, we get a lot of donations from schools and businesses but donations will drop definitely in January. "We couldn't do what we do without the donations from our community." Peter Woodman, from Bracknell Foodbank, said it was "very busy during the festive period". "We see people coming in, you can see how distressed they are and you just welcome them," he said. "You explain things to them and you have professional people who help you there." Lucy Martin, operations manager at Wokingham Foodbank, explained that volunteers had been helping to sort through the donations and "putting them into different sections in the warehouse" to prepare for quieter times.

She said: "Sorting donations involves putting them into different sections and areas so they know how many trays of pasta they've got, or rice, and we also have to date them. "We never have food that's gone out of date, we rotate the stock and know what needs to be used next." She said they were hopeful there was enough food but donations were "always needed".

0 Comments

A record 9.3 million people - including one in five children - are facing hunger and hardship in the UK, according to an anti-poverty charity. This is one million more than five years ago, Trussell said in a new report. Trussell has 1,400 food bank locations, supported by 36,000 volunteers, 12,000 churches, 100,000s of community groups and schools, and millions of people around the UK. The charity said almost a quarter of children under four face hunger and hardship, making them the age group most at risk. Unless changes are made by the government, a further 425,000 people, including 170,000 children, are projected to fall into this category by 2027, it said. A government spokesperson told the BBC that "no child should be in poverty". The report, The Cost of Hunger and Hardship, was published on Wednesday. Trussell worked with economic and public policy experts WPI Economics to analyse government data. It found that one in seven people across the UK face hunger and hardship and one in five children are growing up under these circumstances. This means that 46% more children are facing hunger and hardship than two decades ago. More than half of people currently facing hardship are living in a disabled family, the report said. Trussell said a total of 32% of people in single-parent families face hunger and hardship, and children under four face the highest risk of being in this situation of any age group at 24%. Having employment is not a reliable route out of hardship, the report concluded, with 58% of people facing hunger and hardship living in a family where someone is working. The rate of hunger and hardship is highest for people living in Black, African, Caribbean, or Black British families at 28%, compared to 11% for people living in White families, the report said. The charity is calling on the government to ensure that Universal Credit always covers the basic necessities. It also called for the Local Housing Allowance to be kept in line with affordable local rents. Scrapping the two-child benefit cap would also reduce the number of people facing hunger and hardship by 9%, or 825,000 people, it said. Helen Barnard, director of policy, research and impact at Trussell, said one in seven people facing hunger and hardship "should not be the case in one of the richest countries in the world". "We need urgent action on hunger in the UK because, if nothing changes, the number of people facing hunger and hardship will only increase," she said. "People are turning to food banks because they don’t have enough money to live on. But we know it doesn’t have to be this way." A government spokesperson said it was "taking action" through a new Child Poverty Taskforce, which is "developing an ambitious strategy to give children the best start in life".

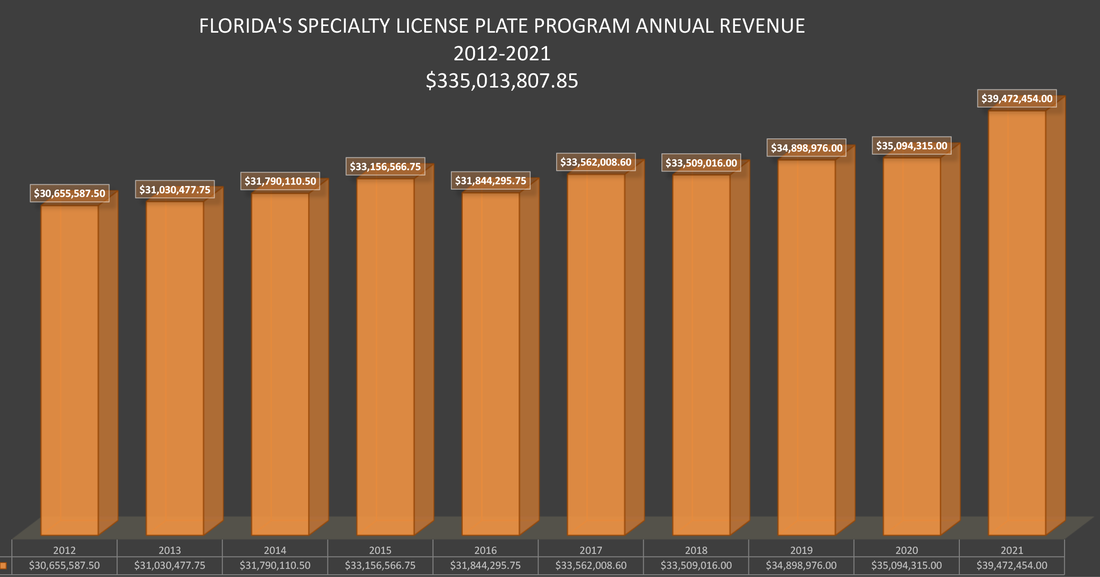

"Alongside this, we have extended the Household Support Fund to support the most vulnerable this winter and have committed to reviewing Universal Credit while we deliver on our plan to tackle inequality and make work pay to deliver opportunity across Britain," the spokesperson said. According to the latest statistics released by the Florida Department of Highway Safety and Motor Vehicles, 1,816,588 specialty license plates were sold in 2021 and a total of $39,472,454.00 was raised, the highest amount in the history of the program.

Prior to 2009, specialty license plate sales increased every year, despite the economic recession. On October 1, 2009, the Florida State Legislature significantly increased vehicle registration fees, particularly with respect to purchasing specialty license plates. In 2009, annual sales of Florida Specialty License Plates amounted to 1,623,486. After 2009, there was a 19.78% decline in Specialty Plate sales, reflecting approximately $7 million lost in annual revenue. In September, 2013, the Florida Legislature reduced some fees associated with vehicle registrations, however, did not address the significant increase in the cost to purchase a new specialty license plate that was imposed in 2009. Despite the increase in fees, specialty plates have now surpassed thospre-2009 numbers, although the number of Florida residents - and Florida registered vehicles - has also significantly increased.  James Bond had a license to kill, but apparently he also wanted his very own license plate. Pierce Brosnan is well-known for his portrayal of James Bond in four films between 1995 and 2002, but most fans are less aware that he once designed a license plate for the state of California. In 2010, Brosnan and his wife Keely were among several people who co-founded the California Spay and Neuter License Plate Fund, with the goal of raising money to sponsor low- or no-cost procedures for pets from low-income families. A few years later, the fund worked with the California Department of Motor Vehicles to offer motorists the opportunity to purchase a special “Pet Lovers” license plate, with funds going toward the cause. While the majority of the plate’s color scheme is based on the standard California design, it also features the image of a purple dog and a cat in sunglasses — which is original artwork by Pierce Brosnan, depicting his adopted dog Shilo and his adopted cat Angel Baby. The fees collected from ordering the Pet Lover’s license plate are still awarded annually to facilities all over California. The money is first sent to the California Department of Food and Agriculture, to be then awarded on a grant basis to animal control units or nonprofit shelters that offer spay and neutering services. In 2021, for instance, the program awarded $330,000 across eight projects to help stop pet overpopulation. This year, there is up to $488,000 available in funding. The pet lover’s license plate can still be requested at California DMV locations and ordered online

The Florida Department of Highway Safety and Motor Vehicles (FLHSMV) announced a new Walt Disney World specialty license plate is now available at tax collector offices and license plate agencies statewide. Plates are being delivered by PRIDE this week. Floridians who purchased presale vouchers for the specialty plate are now also able to redeem them, and those who wish to purchase the new specialty plate may do so now. 32 new specialty license plates were authorized during the 2020 Legislative Session, and the presale process began in October 2020. The Walt Disney World specialty plate is the third plate from the 2020 Legislative Session to have their newly authorized specialty plate meet all design, development, manufacturing, and presale requirements established to begin the distribution process.

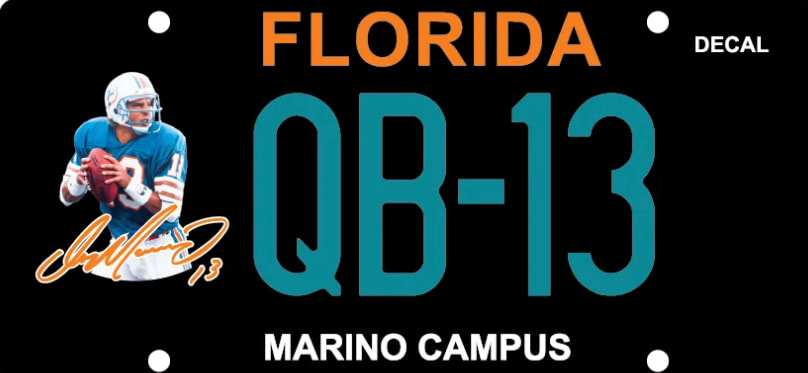

7 more proposed specialty plates will be added to the list of Presale Vouchers on October 1, 2021 including a new plate for Protect Marine Wildlife. More than 10,000 presale vouchers have been purchased by Floridians for the Walt Disney World specialty license plate and it is expected to do very well. Endless Summer is the current top selling specialty license plate. The revenue collected annually from the sale of the Walt Disney World specialty license plate will be distributed to the Make-A-Wish Foundation of Central and Northern Florida, a Florida nonprofit, for activities and programs for families with critically ill children. You can order your Walt Disney plate online now. MyFloridaSpecialtyPlate is awaiting delivery of the tags from the state and should have them in stock this week. Two new Florida specialty license plates are now in a race to complete their Presale Voucher phase, where they have to get 3,000 before the plate will be made - both featuring quarterbacks. The Dan Marino license plate will benefit the Dan Marino Campus, Tom Brady's image is being used to benefit Best Buddies International. Both organizations have chosen a black background, which is trending throughout the United states. So who will be the first to complete their presale? And which plate will sell more? The Florida Legislature prioritized their list of new plates when approving them this year, and the DMV must cycle through them for approval in that order. Marino starts at #11 in the order of plates to be approved, Brady/Best Buddies is at #21. With Tom Brady still playing, and Dan Marino retired, a comparison of the two quarterbacks can still be made. Both were measured at 6' 4" and nearly 225 lbs, Marino was drafted in the 1st round (27th overall) in 1983 and Brady was drafted in the 6th round (199th overall) in 2000. Brady has appeared in 9 Super Bowls, Marino in 1. Brady has been voted NFL MVP 3 times, Marino 1.

Other interesting comparisons: NFL Passing touchdown leader: Brady 2 - Marino 3. NFL Passing Yards Leader: Brady 2 - Marino 5. Touchdown Passes: Brady 50 (2007) - Marino 48 (1984) Passing Yards: Brady 5235 (2011) - Marino 5084 (1984) Interceptions Thrown: Brady 0 (2008) - Marino 3 (1983) Stay tuned! 22,000 nonprofits will close their doors for good in the next 3 years? Michael Towner, Iconic Legacy7/23/2020  It is projected that 22,000 nonprofits will close their doors for good in the next 3 years as a result of the economic crisis. That's the median of several scenarios projected by Candid; it assumes the economic downturn will last 24 months. The 22,000 figure represents a failure rate of 7% among the 315,698 U.S.-based nonprofits whose financial data Candid examined in a new study. Dan Parks reports the new paper presents a less dire forecast than many experts have predicted. "The majority of nonprofit organizations are positioned to weather this storm," the report states. Some charities are hailing the Paycheck Protection Program as a financial saviour, but others say it provided only a brief respite from layoffs and other cost-cutting measures. According to new estimates from the Dorothy A. Johnson Center for Philanthropy at Michigan’s Grand Valley State University, the program saved 4.1 million nonprofit jobs, about a third of all nonprofit jobs in the nation. The study estimated that about 40 percent of eligible nonprofits received a loan and that nearly two-thirds of eligible nonprofit jobs were protected by PPP funds. The study noted that many smaller nonprofits in particular may have missed out by either not applying for loans or not successfully filling out applications. Which kinds of groups have gotten the money so far? Religious organizations, followed by elementary and secondary schools, and civic, social, or social-advocacy organizations, were the most common recipients of PPP loans, According to the data, 42,462 nonprofit organizations received loans of between $150,000 and $10 million. The goal of the Paycheck Protection Program is to encourage employers to keep their workers on the payroll during the coronavirus pandemic. If employers maintain their work force, the loans are mostly forgivable. Of those 42,462 nonprofits, 9,238, or 21.8 percent, were religious organizations; 5,647, or 13.3 percent, were elementary and secondary schools; and 6.3 percent were civic, social, or social-advocacy organizations.  In a survey conducted by the Association of Fundraising Professionals members conducted in May, 2% of respondents said they had been laid off. 20% said their organizations had laid off staff, 23% percent said they had instituted furloughs, and 18% had cut staff pay. Groups that have long relied on in-person fundraising events or revenue from ticket sales are making tough decisions about which fundraising roles are indispensable. Organizations have not eliminated fundraising positions at the same pace that they have laid off people in other departments, says Mike Geiger, President of the Association of Fundraising Professionals. "So far, our numbers are really low in terms of fundraisers being laid off," he says. "I think that is because organizations understand the importance of keeping revenue-generating positions. Fundraisers are the bridge between the donor and the cause. If you break that bridge, if you destroy that bridge, you lose that connection. I think that a lot of CEOs get that, and they might get it now more than they ever did." But even for CEOs and other leaders who understand and value their fundraisers, making staffing decisions when revenue is drying up is a tough balancing act. What is clear is that some organizations and fundraising teams have been harder hit than others. The American Cancer Society has long relied on large in-person fundraising events. And Covid-19 has hit that model especially hard. As events had to be postponed and ultimately canceled or shifted online, the Cancer Society quickly realized it would have to cut costs. The organization did not go to personnel right away, says Mike Neal, the senior executive vice president for field operations. First, it looked to reduce expenses for things like meetings and travel, and postponing events like the Relay for Life walks resulted in some cost savings. But in June, the charity laid off around 1,000 staff members. About 200 were fundraisers, Neal says. The group expects to bring in around $200 million less in 2020 than it had forecast before the coronavirus struck. Smaller groups are also making these tough choices. Cherian Koshy is director of development at Des Moines Performing Arts, an organization that presents visiting plays and other performances — all of which have been canceled or postponed indefinitely. Despite "exceptional" fundraising in recent months, there is no getting around the fact that the organization's business model is partially driven by the money it earns from ticket sales. "Even with a lot of fundraising that has happened over the course of these last few months and the generosity of our donors, it's not enough to keep our entire staff at that total 100 percent, especially when we don't have a date to reopen," he says. So far, Koshy has not had to lay anyone off, but he has had to cut hours. As of July 1, his development team of five people is working the equivalent of 3.5 full-time jobs. "When we talk about lifeboat ethics, there's no good decision about who needs to be tossed off the boat and who gets to stay on," he says. "Everybody's roles are essential in some nature; otherwise, they wouldn't be on the boat in the first place." At some organizations, veteran development directors and senior leaders are getting virtual pink slips, too — delivered via Zoom or over the phone. Barbara Perlov was laid off from her position as director of foundation and government relations at the Boys' Club of New York at the end of March.

The organization has historically relied on wealthy individuals and events, but Perlov was leading the charge to increase support from institutional donors. And even through the pandemic, she saw great potential. She had been working to build relationships with grant makers. Getting the news of her layoff "was shocking," she says. "No doubt about it." "Just getting my head wrapped around the fact that my job was ending was pretty emotional," she says, "not to mention, the personal things going on in my life that I needed to address: what I was going to do about health care, about applying for unemployment." Fundraisers — those who are recently unemployed and those who are plugging away from their home offices — are facing compounding stressors right now. Several fundraisers have lined up part-time consulting work to pay the bills and support organizations in their efforts to raise money through the crisis. In 2014, the mobile camera company GoPro went public, and Nicholas Woodman, the company’s founder and chief executive, was suddenly worth about $3 billion. Later that year, Woodman and his wife, Jill, announced they were establishing a foundation with about $500 million worth of GoPro stock. The foundation, however, was a donor-advised fund. A 2018 New York Times story noted that, four years later, Woodman’s foundation had no website and hadn’t appeared to have funded any significant charitable operations. Google co-founder Larry Page’s use of DAFs has also raised concerns. Last December, an analysis by Recode found Page had stocked more than $400 million in DAFs from 2015 to 2017. In December 2017, Google co-founder Larry Page made what appeared to be generous donations to two charities. To one charity, according to tax records filed by Page’s foundation, he gave $100 million in cash and stock. To the other, records show, Page gave $80 million in cash. Two and a half years later, it’s unclear if any of that money funded any charitable works, or if it’s all still sitting in accounts mostly controlled by Page, collecting interest and earning investment income. That’s because the organizations on the receiving end of Page’s donations were not working charities — such as the American Red Cross or the United Way — but donor-advised funds, a controversial and booming form of philanthropy attracting increasing scrutiny and criticism amid the coronavirus pandemic, as charities face a historic crisis. Page did not reply to a request for comment for this story. Spokesmen at the organizations that received his donations in 2017 — Schwab Charitable and the National Philanthropic Trust — declined to comment, citing privacy rules. Known in the industry as DAFs (rhymes with calves) — and criticized by some insiders as “zombie philanthropy” — the money and assets in donor-advised funds are intended to go to charity some day, but there are no payout requirements, and money can sit in a donor-advised fund for decades. DAFs are the fastest growing form of charitable spending in America, with more than $120 billion in DAF accounts across the country in 2018, according to the most recent industry estimates, up from $45 billion just six years earlier. And while some executives who oversee these funds say critics exaggerate potential abuses, the coronavirus pandemic has prompted a few wealthy DAF users to express rising concern about the way these funds are managed. “Charities are slammed for work, needing to do more than ever before … and yet this $120 billion is still sitting there … It’s kind of crazy,” said David Risher, a former Microsoft and Amazon executive who — with his wife, Jennifer — launched the #HalfMyDaf campaign in May to try to inspire donors to pay out at least half the money in these accounts to charities this year. “The money is sitting there because people often have a plan for their philanthropy,” said Jennifer Risher, a former manager at Microsoft and author. “Well, the world is not on plan right now. Now is the moment.” The Rishers’ echoed concerns raised by Kat Taylor — philanthropist, banking executive and wife to hedge fund manager and former presidential candidate Tom Steyer — who is a vocal critic of the DAF system and has supported draft legislation in California this year that would require more oversight and impose transparency obligations on these funds. “They were created without, I think, as much oversight and foresight as we should have given them,” Taylor said. “These are the piggy banks of charity. We should be breaking our piggy banks right now.” The rise of what some critics denounce as “a perversion of the tax code” traces its roots to 1969, when Congress rewrote the tax code to favor public charities over private foundations, imposing more taxes on private foundations and requiring more public information on their finances. To Norman Sugarman, a former IRS attorney in Cleveland, this created both concern and opportunity. Sugarman represented community foundations fearful the new law would scare off donors. “For him, it was important that, no questions asked, these [community foundations] were public charities,” said Lila Corwin Berman, a history professor at Temple University who has written about Sugarman’s role in the popularization of DAFs. “He believed most social problems could be better solved by charity than government, and that individuals should have more control over what their wealth could do for society.” Sometimes, however, the money is just moving from one donor-advised fund to another donor-advised fund. A 2017 analysis by the Economist magazine of data from three of the largest donor-advised funds found two of the three largest recipients of their charitable spending were other donor-advised funds. (Account holders can move money and assets from one fund to another in search of better fees.) “You start to kind of wonder … where is all the money?” David Risher said. “And then you realize that you have these funds that have more than $120 billion parked in them … and when you look at a system like this, you start to realize that there are financial incentives at some organizations, where the status quo is working pretty well for them.” Original story by Will Hobson, Washington Post. Click here for more.

The $2 trillion stimulus bill expands the charitable deduction to all taxpayers for a year, makes nonprofits eligible for federal loans that could be largely forgiven, and boosts tax incentives for corporate giving, according to nonprofit analysts. Currently, only people who itemize their taxes can claim charitable deductions. The stimulus bill will allow nonitemizers to deduct up to $300 in cash giving for the 2020 tax year, according to an analysis of the legislation by the National Council of Nonprofits. Donations to donor-advised-fund accounts would not qualify for the nonitemizer deduction, according to Dean Zerbe, national managing director at AlliantGroup and a former top tax aide for the Senate Finance Committee. Nonprofits have long sought a "universal deduction," especially since the tax law of 2017 roughly doubled the standard deduction and sharply reduced the number of people who itemize their taxes. The Senate voted unanimously Wednesday to pass the bill. The House is expected to approve it today, and President Trump has said he will sign it. For those who itemize, the bill lifts the cap on annual giving from 60 percent of adjusted gross income to 100 percent. For corporate charitable giving, the bill raises the annual limit from 10 percent to 25 percent of taxable income. The cap on deductibility of food donations from corporations would increase to 25 percent of taxable income, up from the current 15 percent cap. More Help for Nonprofits

Other provisions of the bill affecting charities, according to the National Council of Nonprofits and other sources:

Although nonprofit advocates are seeking more federal help for charities than the bill provides, including a $60 billion aid package specifically for nonprofits, there was widespread approval of the legislation with hopes for more to come later, including expanding the universal deduction. "There is much to celebrate in this deal, but still a lot of advocacy needed," said Tim Delaney, president and CEO of the National Council of Nonprofits, in an emailed statement. "Additional funding resources will be absolutely critical in the months to come," wrote Charlotte Haberaecker, CEO of Lutheran Services in America. Independent Sector, a Washington-based nonprofit membership organization. By Dan Parks, Chronicle of Philanthropy. After the stock market had its worst day since the crash that touched off the 2008 financial crisis, experts urged nonprofits to prepare their finances for the possibility that the economy would face a long-term setback from the coronavirus pandemic. Nobody knows whether the economy will face as deep a struggle as it did in 2008, a year when charitable giving plunged 5.7 percent, according to "Giving USA," the steepest decline since it began its survey in 1956. Fundraising consultants and nonprofit experts urged charities to start planning for a prolonged recession — but some also cautioned that it’s too soon to make any drastic moves, like cutting staff, because it’s not clear yet whether a recession is imminent. Dan Thain, chief fundraising strategist and creative director at Blue State, said nonprofits should stick with their current fundraising strategies despite the turmoil upending financial markets. "There are so many unknown unknowns at the moment," Thain said. "My advice would be to push on, but pull back if you’re not seeing the response rates that you would typically see." Meanwhile, nonprofits should be frugal and try to pad their reserves where possible, he said.

"There is a huge threat to the economy right now, which could have a decisive impact on what fundraising looks like in the coming months, if not years," Thain said. Using Reserve Funds Jerry Hauser, CEO, of the Management Center, said nonprofits should look at the current market turmoil "as a one-time or short-lived event" and said nonprofits should avoid laying off staff or making other major structural changes under the assumption that a recession is imminent. "It’s too soon to say we’re in for a long, rough road, and it’s too risky to erode your ability to deliver on needed programs," Hauser said. And while Thain said nonprofits should look to pad their reserves, Hauser said now may be the right time to dip into them, for those nonprofits fortunate enough to have available funds in the bank. He suggested that while nonprofits may take a short-term fundraising hit, the current market turmoil could pass relatively quickly. "This is a good time for organizations to consider using their reserves, something I’m usually very cautious about," Hauser said. Sandi Clement McKinley, vice president for advisory services for the Nonprofit Finance Fund, agreed that the coming weeks and months may be a good time for nonprofits to consider dipping into reserves, if available, while making a commitment to restore those reserves later. That’s a conversation that should include the board of your nonprofit, she said. She also urged nonprofits to focus on their core missions at a time like this and to shelve plans to expand into areas where they don’t currently have expertise or experience. "Remember why you are here and who you are serving," McKinley said. McKinley warned that the economy could suffer for an extended period even after the coronavirus threat wanes. "Nonprofits and their funders should be considering the big picture of weathering an economic recession and taking action to make sure nonprofits survive and can ably serve their communities for an extended time," she said. Kathryn Kennedy a partner at Cerity Partners, a financial advisory firm in Chicago, agreed that many donors are taking a wait-and-see approach to the impact of the coronavirus. "People are trying to understand it and understand the government and big foundation responses," Kennedy said. Kennedy said that despite the ongoing turmoil in the stock market, she expects charitable giving from wealthy donors to hold up: "These are people who have a dedicated commitment to being charitable and they will continue to give." |

BLOGArchives

January 2025

Categories

All

|