|

The $2 trillion stimulus bill expands the charitable deduction to all taxpayers for a year, makes nonprofits eligible for federal loans that could be largely forgiven, and boosts tax incentives for corporate giving, according to nonprofit analysts. Currently, only people who itemize their taxes can claim charitable deductions. The stimulus bill will allow nonitemizers to deduct up to $300 in cash giving for the 2020 tax year, according to an analysis of the legislation by the National Council of Nonprofits. Donations to donor-advised-fund accounts would not qualify for the nonitemizer deduction, according to Dean Zerbe, national managing director at AlliantGroup and a former top tax aide for the Senate Finance Committee. Nonprofits have long sought a "universal deduction," especially since the tax law of 2017 roughly doubled the standard deduction and sharply reduced the number of people who itemize their taxes. The Senate voted unanimously Wednesday to pass the bill. The House is expected to approve it today, and President Trump has said he will sign it. For those who itemize, the bill lifts the cap on annual giving from 60 percent of adjusted gross income to 100 percent. For corporate charitable giving, the bill raises the annual limit from 10 percent to 25 percent of taxable income. The cap on deductibility of food donations from corporations would increase to 25 percent of taxable income, up from the current 15 percent cap. More Help for Nonprofits

Other provisions of the bill affecting charities, according to the National Council of Nonprofits and other sources:

Although nonprofit advocates are seeking more federal help for charities than the bill provides, including a $60 billion aid package specifically for nonprofits, there was widespread approval of the legislation with hopes for more to come later, including expanding the universal deduction. "There is much to celebrate in this deal, but still a lot of advocacy needed," said Tim Delaney, president and CEO of the National Council of Nonprofits, in an emailed statement. "Additional funding resources will be absolutely critical in the months to come," wrote Charlotte Haberaecker, CEO of Lutheran Services in America. Independent Sector, a Washington-based nonprofit membership organization. By Dan Parks, Chronicle of Philanthropy.

0 Comments

Opinion by John MacIntosh (CNN). John MacIntosh is the managing partner of SeaChange Capital Partners, a nonprofit merchant bank in New York that helps nonprofits work through complex challenges. Covid-19 is poised to become an extinction-level event for America's nonprofits. Cultural institutions have been forced to close their doors. Organizations working in and around public schools or in senior centers cannot provide services because their clients are not showing up. Fundraising events have been canceled. Many essential front-line social services -- e.g., operating homeless shelters -- cannot be delivered remotely and pose particular risks of infection, increasing the costs of keeping staff safe. Unless government, funders and nonprofit leaders take immediate and decisive action, many nonprofits around the nation may just disappear over the next few months leaving those they serve and employ in disastrous circumstances. Although the federal government and the press are focused on the plight of the big industries -- airlines, hotels, cruise ships -- nonprofits employ more people than many of these industries. Furthermore, nonprofits typically don't have the cash, credit lines assets (e.g. ships, planes, landing rights, brand names) or lobbyists that guarantee the survival of these industries in one shape or another. Treasury Secretary Steven Mnuchin has noted that small businesses must have sufficient funds to stay afloat. Most nonprofits are purpose-driven, small businesses "owned" by the public. Their survival is arguably even more important than that of similar for-profit businesses because they work with, and often employ, the most vulnerable people. It's important that any relief for small business includes nonprofit small business as well. The truth is that our capitalist system will likely quickly rebuild the for-profit ecosystem after the Covid-19 crisis has passed. Planes will fly. Cruise ships will sail. New restaurants will emerge to take the place of those that failed, buying the fixed assets at a discount, occupying the same storefronts at lower rents and serving the same clientele. Unfortunately, nonprofits that fail cannot be so easily replaced or restarted. Few have the type of hard, tangible assets that can survive a gap in service. There is no all-powerful profit-motive to fuel a reconstruction. Philanthropy is not good at providing front-loaded, restart capital at scale. While the nonprofit sector is often taken for granted, it provides much of what is most valuable in social service, arts and culture, recreation and education. For example, the countless nonprofits delivering human services represent a $200 billion industry that touches the lives of more than 1 in 5 Americans, including: housing more than 200,000 elderly Americans, providing homes to 670,00 foster children and serving food to 46 million people through food banks. Just how bad could it be? Our earlier analysis of nonprofits suggests that less than half of nonprofits have one month of operating reserves and less than six months of cash to keep them running. Without outside help, the trajectory of demise for many nonprofits is clear: the executive directors and boards delay taking tough restructuring actions; the organizations have to stiff their vendors, then furlough or lay off staff; the founders stop paying themselves; and finally, they shut down when the bank account is dry and payroll can't be made. The failure of Federation Employment & Guidance Service (FEGS) in 2015, then New York City's largest social service agency, should remind us how damaging it can be when a big nonprofit fails, leaving vulnerable people—the home-bound, the developmentally disabled, the homeless, foster-children—without services. Fortunately, FEGS failed for idiosyncratic, self-inflicted reasons and was surrounded by healthy groups -- like the Jewish Board of Family and Children's Services -- who were able to pick up the pieces. Nonprofit leaders and boards: Be tough-minded. Nonprofits must go into cash-conservation mode. It is hard to stiff vendors, lay people off, furlough or reduce pay or take advantage of eviction-stays to simply not pay the rent. But a tough restructuring allowing for survival and the continuation of the mission (which is a nonprofit's sole reason for being) is far better than hitting the wall and closing up shop altogether. Nonprofits should also explore mergers, consolidations and the divestment of "non-core" programs, though the number of "takers" is probably small in the midst of a crisis. They must learn to play "hard ball" and remember that a nonprofit cannot be involuntarily put into bankruptcy by its creditors. If hitting the wall is inevitable, leaders must resist magical thinking and plan for a sensible dissolution that aims to preserve and transition services for those in need. Making the best of a terrible situation may be the only thing leaders can do. Foundations: Step up and be creative. Foundations should boost their support now to keep nonprofits in business and then, if necessary, cut their spending in future years once these organizations are back on their feet. The only thing that prevents foundations from giving more now is their desire not to privilege the present over the future. But at this moment the present needs privileging. It is heartening that in Seattle, Silicon Valley, Philadelphia, New York and other cities, philanthropic leaders are actively exploring (or have already created) collaborative rapid response funds. These funds need to be able to make fast decisions and should offer loans, grants and guarantees. They should support nonprofits, underlying individuals (both clients and staff), restructurings and even managed dissolutions. Rich people: If not now, when? Despite the paper losses in their portfolios due to the crisis, the 1% have never been more (relatively) privileged than they are right now. They can work from their second homes, can meet monthly expenses, and some—like distressed investors—may even profit from the carnage. They should front-load their giving by paying for next year's theatre season this year, giving as if they had attended a canceled gala, accelerating multi-year pledges, and more. Those who had been planning to be more philanthropic in the future —for example, the Giving Pledgers who have yet to give much—must ask themselves "If not now, when?" Government: Be a good partner. Nonprofits that cannot do the work through no fault of their own should still be paid (teachers are paid if school is closed). Government agencies should waive normal procurement procedures to get contracts registered and bills paid on an accelerated basis. They should defer the recoupment of advances. They should ease performance-based payment requirements. They should recognize that protecting the Systemically Important Nonprofit Institutions will be less costly—in financial and human terms—than letting them fail and scrambling to pick-up the pieces. Initiatives to provide zero-interest loans and employee-retention grants to support small businesses should be extended to include nonprofits. Even if we do all this, many nonprofits will still disappear. Some will likely close their doors in the next six months, more over the next two years. Work that has been going on for decades or longer may vanish. But hopefully the passion and people once invested in these organizations will, after we get through this mess, find its way back into the sector. We can't afford to lose these precious resources. The work of nonprofits and the passion of their people will be more important than ever as we rebuild the post-Covid-19 world. Part of that rebuilding must include putting in place the systems to ensure that we are better prepared next time. As the COVID-19 virus continues to spread and its impact is being felt across the world, we understand the welfare of your people is a primary concern. MyFloridaSpecialtyPlate will continue to process online applications and continue to help the numerous charities and state agencies, some of which entirely depend on the revenue from specialty license plates. We hope you continue to support these worthwhile causes as less and less people venture out to Tax Collector and DMV offices and revenue from specialty plates reduces. Please consider supporting the causes specified for each plate, as Covid-19 is poised to become an extinction-level event for many of America's nonprofits.

Processing times are being impacted, but processing is continuing as best we can. After the stock market had its worst day since the crash that touched off the 2008 financial crisis, experts urged nonprofits to prepare their finances for the possibility that the economy would face a long-term setback from the coronavirus pandemic. Nobody knows whether the economy will face as deep a struggle as it did in 2008, a year when charitable giving plunged 5.7 percent, according to "Giving USA," the steepest decline since it began its survey in 1956. Fundraising consultants and nonprofit experts urged charities to start planning for a prolonged recession — but some also cautioned that it’s too soon to make any drastic moves, like cutting staff, because it’s not clear yet whether a recession is imminent. Dan Thain, chief fundraising strategist and creative director at Blue State, said nonprofits should stick with their current fundraising strategies despite the turmoil upending financial markets. "There are so many unknown unknowns at the moment," Thain said. "My advice would be to push on, but pull back if you’re not seeing the response rates that you would typically see." Meanwhile, nonprofits should be frugal and try to pad their reserves where possible, he said.

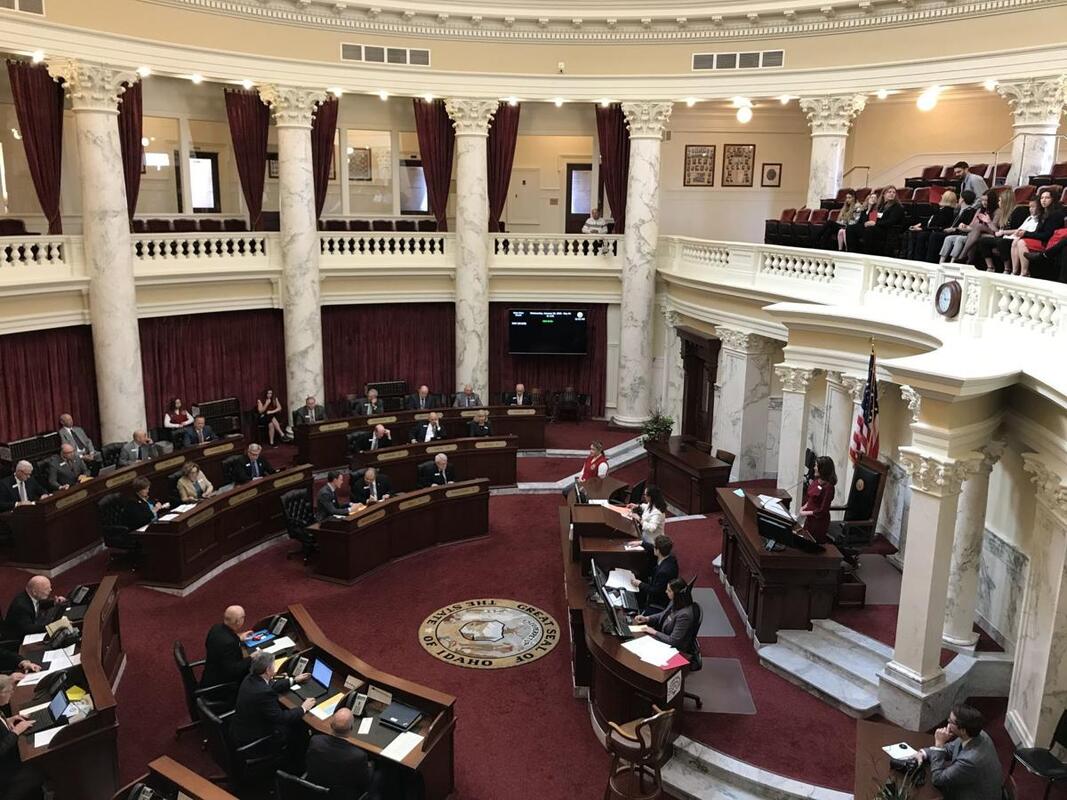

"There is a huge threat to the economy right now, which could have a decisive impact on what fundraising looks like in the coming months, if not years," Thain said. Using Reserve Funds Jerry Hauser, CEO, of the Management Center, said nonprofits should look at the current market turmoil "as a one-time or short-lived event" and said nonprofits should avoid laying off staff or making other major structural changes under the assumption that a recession is imminent. "It’s too soon to say we’re in for a long, rough road, and it’s too risky to erode your ability to deliver on needed programs," Hauser said. And while Thain said nonprofits should look to pad their reserves, Hauser said now may be the right time to dip into them, for those nonprofits fortunate enough to have available funds in the bank. He suggested that while nonprofits may take a short-term fundraising hit, the current market turmoil could pass relatively quickly. "This is a good time for organizations to consider using their reserves, something I’m usually very cautious about," Hauser said. Sandi Clement McKinley, vice president for advisory services for the Nonprofit Finance Fund, agreed that the coming weeks and months may be a good time for nonprofits to consider dipping into reserves, if available, while making a commitment to restore those reserves later. That’s a conversation that should include the board of your nonprofit, she said. She also urged nonprofits to focus on their core missions at a time like this and to shelve plans to expand into areas where they don’t currently have expertise or experience. "Remember why you are here and who you are serving," McKinley said. McKinley warned that the economy could suffer for an extended period even after the coronavirus threat wanes. "Nonprofits and their funders should be considering the big picture of weathering an economic recession and taking action to make sure nonprofits survive and can ably serve their communities for an extended time," she said. Kathryn Kennedy a partner at Cerity Partners, a financial advisory firm in Chicago, agreed that many donors are taking a wait-and-see approach to the impact of the coronavirus. "People are trying to understand it and understand the government and big foundation responses," Kennedy said. Kennedy said that despite the ongoing turmoil in the stock market, she expects charitable giving from wealthy donors to hold up: "These are people who have a dedicated commitment to being charitable and they will continue to give." The Senate has voted 34-0 in favor of Sen. Patti Anne Lodge’s bill to stop approving new specialty license plates after this year unless they’re for state entities, and to phase out existing specialty plates if they don’t meet specified sales targets. “Usually you have to pay to advertise your cause,” Lodge said, saying Idaho has too many specialty plates. Current Idaho specialty plates range from the Appaloosa and bluebird plates to snow skier plates and whitewater rafting plates. Specialty plates are optional and come with extra fees to cover both the cost of producing them, and donations to the cause in question, from the Idaho Department of Fish & Game to 4-H. Sen. Jim Rice, R-Caldwell, spoke out in favor of Lodge’s bill, SB 1349a. “This stops doing new specialty plates,” he said. “That’s something that’s a bit of an annoying thing that we keep adding more of.”

This year, one new specialty license plate already has passed both houses, the “Choose Life” plate, and a “Too Great for Hate” specialty plate, to benefit the Wassmuth Center for Human Rights, has passed the Senate and is awaiting a hearing in the House. Lodge's bill now moves to the House. Virginia lawmakers have passed legislation that will create a new license plate with the slogan “VB Strong” honoring the victims of a mass shooting in Virginia Beach. The bill sponsored by Sen. Bill DeSteph has passed unanimously out of both chambers and heads to the governor’s desk for his signature, The Virginian-Pilot reported Wednesday. The plates won’t be available until 450 people apply for them and pay a $10 fee that goes toward Department of Motor Vehicles operations by Nov. 20. “It was a horrific tragedy, and we felt like this was just one way that people could help memorialize the event and ensure that people know that the tragic events that occurred that day are not going to be forgotten,” said Scott Humphrey, a legislative aide for DeSteph’s office. The DMV offers more than 250 specialty license plates.  Top Row (left to right): Laquita C. Brown, Tara Welch Gallagher, Mary Louise Gayle, Alexander Mikhail Gusev - Middle Row (left to right): Katherine A. Nixon, Richard H. Nettleton, Christopher Kelly Rapp, Ryan Keith Cox - Bottom Row (left to right): Joshua A. Hardy, Michelle 'Missy' Langer, Robert 'Bobby' Williams, Herbert 'Bert' Snelling (Source: City of Virginia Beach/MGN) |

BLOGArchives

January 2025

Categories

All

|